Faucet and Tapware Packaging Market 2026 Recent Trends, Demand, Dynamic Innovation in Technology & Insights 2036

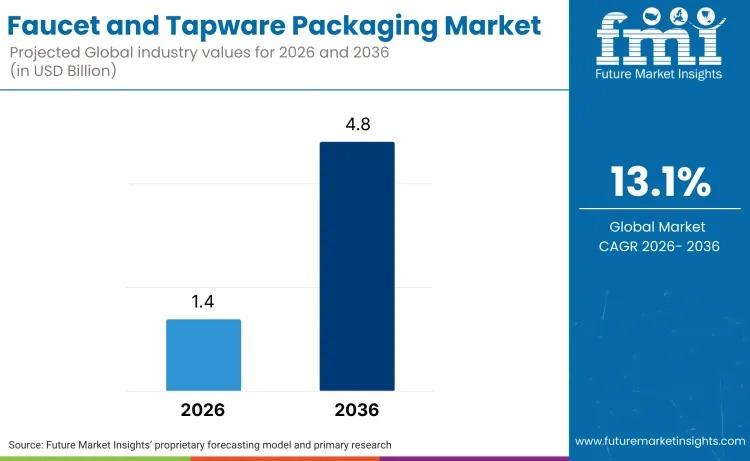

The global faucet and tapware packaging market is entering a transformative decade. Valued at USD 1.4 billion in 2026, the market is forecast to reach USD 4.8 billion by 2036, expanding at a remarkable 13.1% CAGR. This growth is not simply volume-driven—it is powered by a structural shift away from petrochemical foams toward recyclable, fiber-based and bio-derived protective materials. As major fixture brands accelerate sustainability commitments ahead of 2030 environmental targets, packaging has become a strategic priority rather than a back-end cost. From Europe to North America and Asia, OEMs are mandating plastic-free compliance across their supply chains, reshaping material selection, production infrastructure, and capital allocation across the packaging industry.

Industry Meaning

The faucet and tapware packaging market encompasses protective and retail-ready packaging solutions engineered specifically for plumbing fixtures such as kitchen faucets, bathroom taps, showerheads, and valves. These products require specialized cushioning to protect scratch-sensitive chrome, brass, matte black, and premium designer finishes during international shipping and last-mile delivery.

Packaging in this category includes:

- Molded pulp inserts and cradles

- Corrugated retail boxes and structural inserts

- Bio-based cushioning materials (wool, hemp, mushroom, cellulose foams)

- Protective wraps and rigid gift-style packaging for premium fixtures

Unlike general packaging markets, this segment is defined by its need to combine high-impact resistance with surface protection, while increasingly meeting curbside recyclability and sustainability standards.

Request For Sample Report | Customize Report |Purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31874

Strategic Outlook

The faucet and tapware packaging market is being reshaped by what analysts describe as a “material substitution dynamic.” Expanded polystyrene (EPS) and polyethylene (PE) foams are being phased out in favor of molded fiber and advanced cellulose-based alternatives. Companies such as Hansgrohe and LIXIL have announced aggressive plastic elimination initiatives. Hansgrohe’s commitment to 100% plastic-free packaging for new products by 2025 is forcing converters to rapidly scale molded fiber capacity. This transition is capital intensive. Large packaging players are investing heavily in wet-press molded pulp systems, premium pulp finishing, and advanced fiber-molding infrastructure. The strategic battle is no longer about cost alone it is about who can deliver plastic-free protection without compromising finish integrity.

Market Evolution

Historically, faucet packaging relied heavily on foam blocks and polybags to protect heavy brass fixtures. However, sustainability mandates, especially in Europe under evolving packaging waste regulations, are driving rapid redesign cycles. By 2036, molded fiber is projected to command the dominant share of the market, currently accounting for 44% of cushion material usage. Wet-pressed fiber technologies are eliminating traditional pulp “dusting” and rough textures, enabling smooth-surface inserts suitable for luxury tapware. Innovation partnerships are accelerating this shift. For example, collaborations between material producers and converters are testing cellulose foams that replicate the cushioning performance of plastic while remaining recyclable in paper streams. This signals a move toward engineered bio-material systems capable of replacing petrochemical solutions at scale.

Growth Opportunities

Several high-impact growth drivers are shaping the decade ahead:

- Residential renovation cycles driving retail-ready packaging demand (42% share)

- E-commerce growth requiring parcel-grade protective systems

- Luxury tapware requiring premium unboxing experiences

- Export compliance demands in China and Southeast Asia

- Scaling of bio-based materials such as hemp pulp and mushroom packaging

China is projected to grow at 13.6% CAGR, driven largely by export compliance pressures from Western markets. Germany and the USA are also emerging as fiber-molding investment hubs as domestic manufacturing aligns with sustainability mandates.

The market’s high CAGR reflects not just demand growth, but a mass conversion cycle as companies retrofit production lines from EPS to fiber-based solutions.

Demand Patterns

Demand patterns highlight clear structural preferences:

- Residential fixtures dominate (42% share), driven by retail and DIY channels

- Molded-pulp cradles lead protection systems (38% share)

- Molded fiber commands 44% of cushion material usage

- Premium designer taps increasingly require rigid gift-style packaging

Retail-ready packaging must balance protection with brand presentation. As more consumers purchase bathroom fixtures online, packaging must withstand handling while delivering a frustration-free unboxing experience. Premium brands in Italy and Germany are pushing the “Premium Pulp” trend demanding dust-free, high-finish molded fiber inserts that complement luxury aesthetics.

Technology Trends

The market is experiencing a wave of material innovation. Wet-pressed pulp technologies now enable smoother, high-precision molded inserts capable of protecting scratch-sensitive chrome finishes. Bio-material startups are entering the field with hemp-based pulp, waste wool cushioning, and mycelium-grown packaging structures. These solutions aim to reduce carbon footprint while solving the abrasion risks traditionally associated with rough pulp surfaces. Wood-foam and cellulose-based cushioning technologies are also gaining attention as viable replacements for PE foam. These materials mimic foam shock absorption while remaining fully recyclable in paper streams.

The future of faucet packaging lies in engineered fiber systems strong, smooth, recyclable, and scalable.

Competitive Landscape

The competitive environment is intensifying, described by many as a “green arms race.” Major players are deploying significant capital into sustainable packaging capacity. Companies such as Stora Enso, Smurfit Kappa, Berry Global, and DS Smith are expanding molded fiber production and sustainable materials R&D. Innovation partnerships are critical. Collaborations between packaging material producers and fixture OEMs are accelerating pilot projects in cellulose foams and high-load molded pulp. Meanwhile, emerging players focusing on hemp pulp and waste-wool cushioning are targeting niche luxury and export-compliance segments. Scale is becoming a competitive advantage. Larger players with established fiber infrastructure enjoy lower unit costs and faster compliance turnaround, creating high barriers to entry for smaller converters.

Executive-Level Insights

- Market value (2026): USD 1.4 billion

- Forecast value (2036): USD 4.8 billion

- CAGR: 13.1%

- Leading cushion material: Molded fiber (44% share)

- Dominant fixture class: Residential fixtures (42%)

- Fastest-growing country: China (13.6% CAGR)

- Strategic driver: Regulatory de-plasticization and OEM mandates

Outlook

The faucet and tapware packaging market is undergoing one of the fastest sustainability-driven transitions in the durable goods sector. As plastic elimination becomes non-negotiable, fiber-based innovation, bio-material scaling, and premium pulp engineering are redefining protection standards. By 2036, the market will not only be larger it will be fundamentally different. Packaging will serve as both environmental compliance tool and brand differentiator, positioning this segment at the forefront of the global material transformation.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain:

Conductive Polymer Packaging Market: https://www.futuremarketinsights.com/reports/conductive-polymer-packaging-market

Anti-Microbial Edible Packaging Market: https://www.futuremarketinsights.com/reports/anti-microbial-edible-packaging-market

Labeling and Coding Equipment Market: https://www.futuremarketinsights.com/reports/labeling-and-coding-equipment-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

- Искусство

- Разработка

- Ремесло

- Танцы

- Напитки

- Фильмы

- Фитнес

- Еда

- Игры

- Садоводство

- Здоровье

- Дом

- Литература

- Музыка

- История и факты

- Другое

- Вечеринка

- Религия

- Поход по магазинам

- Спорт

- Театр

- Новости