Aluminum Extrusion Market Growth Overview, Facts & Figures, Segmentation, Future Trends, and Historical Analysis

Aluminum Extrusion Market is projected to grow from USD 111.88 billion in 2024 and to reach USD 166.65 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. This report provides a comprehensive analysis of the market, including size, share, drivers, aluminum extrusion market trends, and constraints, competitive aspects, and prospects for future growth. The diverse attributes, coupled with the increasing number of applications, can be pointed out as the main drivers of the demand for aluminum extruded products across industries. Aluminum extruded products are gaining popularity in construction & infrastructure, automotive & mass transport, electrical & electronics, and machinery & equipment, where their high strength-to-weight ratio and corrosion resistance are appreciated.

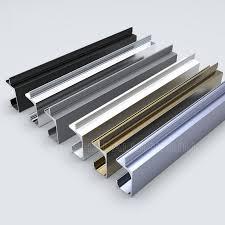

The construction industry is considered one of the major end users of aluminum extruded products. Aluminum is considered one of the most viable building materials due to the wide range of benefits it offers, such as light strength-to-weight ratio, sustainability, recyclability, and versatility. Aluminum is widely used in construction as it helps building projects qualify for green building status under the Leadership in Energy and Environmental Design (LEED) standards. Aluminum extruded products serve critical roles in automotive & mass transport, electrical & electronics, and machinery & equipment owing to their lightweight strength, corrosion resistance, and design flexibility, which support efficiency, sustainability, and performance needs.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=105145109

Market Dynamics:

Driver: Expanding adoption in the automotive industry

The growing emphasis on vehicle lightweighting to enhance fuel efficiency, extend electric vehicle (EV) driving range, and comply with tightening emission regulations is a major driver of the aluminum extrusion market. Aluminum extrusions are increasingly replacing conventional steel components due to their superior strength-to-weight ratio. In electric vehicles, extrusions play a critical role in offsetting battery weight, enabling range improvements of up to 15%. Regulatory bodies such as the EPA and other global agencies mandate lower tailpipe emissions, pushing automakers to adopt aluminum-based body panels, structural components, bumpers, and thermal management systems to achieve overall weight reductions of 10–20%. Asia Pacific and North America remain key growth hubs, supported by large-scale EV manufacturing in China, the US, and India, where demand for complex and high-performance extrusion profiles is accelerating.

Restraint: Energy-intensive production process

High energy consumption remains a notable restraint for the aluminum extrusion market, significantly impacting production economics and sustainability goals. The extrusion process requires billets to be heated to temperatures ranging from 450°C to 550°C, consuming approximately 1,000–1,500 kWh per ton, with total energy usage in traditional setups reaching up to 14,000 kWh per tonne. Heating, extrusion pressing, and quenching account for nearly 70–80% of overall energy demand. In regions with elevated electricity prices, such as Europe and North America, this translates into operating cost increases of 20–30%. Additionally, elevated carbon emissions conflict with net-zero targets, discouraging long-term investments. In Asia Pacific, dependence on coal-based power and intermittent energy supply further raise costs and prolong lead times, restricting capacity expansion despite strong demand from construction and automotive sectors.

Opportunity: Adoption of advanced and smart manufacturing solutions

Technological advancements are creating significant opportunities in the aluminum extrusion market by enhancing precision, efficiency, and customization capabilities. The deployment of next-generation extrusion presses, multi-cavity dies, and digitally controlled systems enables the production of complex profiles with tight dimensional tolerances and improved surface quality. Additive manufacturing technologies are increasingly used to fabricate intricate extrusion dies and accelerate prototyping cycles, allowing manufacturers to integrate advanced design features such as internal cooling channels and lightweight lattice structures. Furthermore, automation, robotics, and AI-enabled process control systems are transforming operations by optimizing material flow, improving quality inspection accuracy, reducing defect rates, and shortening production timelines, thereby boosting overall productivity and profitability.

Get a Sample Copy of This Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=105145109

Challenge: Fluctuating raw material prices

Price volatility of aluminum billets presents a persistent challenge for extrusion manufacturers, driven largely by energy costs, supply-demand imbalances, and trade policies. Aluminum prices on the London Metal Exchange have fluctuated widely between USD 1,800 and 2,400 per ton, influenced by factors such as Chinese smelting capacity, unstable electricity prices—which account for nearly 40% of production costs—and geopolitical developments including trade tariffs. For instance, elevated import duties in the US significantly increased regional premiums. Additionally, bauxite supply constraints and smelting power costs of 13–15 MWh per ton contribute to price swings, pushing aluminum costs to USD 1,500–3,500 per metric ton. As raw materials represent 70–80% of operating expenses, even minor price increases can erode profit margins of 25–35% and delay project execution. While some producers turn to recycled aluminum to manage costs, contamination issues often reduce recycled material value by 10–50%, limiting its economic advantage.

The hollow profiles segment is projected to record the highest CAGR in the aluminum extrusion market during the forecast period.

Demand for hollow aluminum profiles is increasing due to their high strength-to-weight ratio, which supports lightweighting requirements across electric vehicles, renewable energy systems, and construction applications. Hollow profiles use less material while delivering bending and torsional strength comparable to solid sections, making them suitable for weight-sensitive uses such as vehicle frames and solar mounting structures. Rising EV production is boosting demand for hollow extrusions in battery enclosures, chassis components, and thermal management systems, helping reduce vehicle weight and improve range and efficiency. In renewables and mass transport, hollow profiles are used in support structures and rail components owing to their corrosion resistance and ease of installation. The construction and machinery sectors are also adopting modular and prefabricated designs for energy-efficient buildings and equipment, supported by urbanization and sustainability initiatives.

The 6xxx alloy grade is expected to hold the largest share of the aluminum extrusion market during the forecast period, in terms of value.

Based on alloy grade, the market is segmented into 6xxx, 1xxx, 5xxx, and other grades, with 6xxx alloys accounting for the largest share due to their balanced combination of strength, corrosion resistance, formability, and extrudability. These properties make them suitable for high-volume applications across automotive, construction, and industrial sectors. 6xxx alloys offer good weldability, excellent surface finish for anodizing or painting, and enhanced strength through precipitation hardening in T5 and T6 tempers. Common grades such as 6061, 6063, and 6005 are widely used, with 6061 preferred for structural and automotive applications, 6063 favored for architectural uses, and 6005 used in infrastructure applications due to its corrosion resistance and ease of extrusion.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=105145109

The mill-finished segment is expected to dominate the aluminum extrusion market during the forecast period.

Based on surface finish, the market is segmented into mill-finished, anodized, and powder-coated products, with mill-finished extrusions projected to grow at the highest rate. Mill-finished products refer to aluminum surfaces in their as-extruded or rolled form, which may later undergo machining or secondary finishing. Surface characteristics vary depending on production conditions, ranging from oxidized hot-rolled finishes to smooth extruded surfaces with visible die lines. Mill-finished extrusions are widely used in window and door frames, tubes, rods, and bars due to their cost-effectiveness, versatility, and suitability for further processing in construction, infrastructure, and automotive applications.

The construction & infrastructure sector is estimated to be the fastest-growing end-use industry in the aluminum extrusion market.

By end-use industry, the market is segmented into construction & infrastructure, automotive & mass transport, electrical & electronics, machinery & equipment, and others. Construction and infrastructure represent a major consumption segment, supported by aluminum’s lightweight nature, strength, durability, recyclability, and design flexibility. Aluminum extrusions are widely used in building structures, facades, and framing systems, and their sustainability benefits help projects meet green building standards such as LEED.

Asia Pacific is projected to register the highest CAGR during the forecast period.

The aluminum extrusion market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is witnessing strong demand driven by rapid industrialization, urban expansion, and large infrastructure projects. Growth in automotive, electronics, and manufacturing industries is increasing demand for lightweight aluminum components, particularly for electric vehicles and consumer products. Expanding renewable energy installations and stricter emission regulations further support aluminum usage, while advancements in automation and alloy development are enabling large-scale production and capacity expansion across the region.

The major players active in the aluminum extrusion market are based in Asia Pacific, North America, and Europe. Jindal Aluminum Limited (India), Hindalco Industries Ltd. (India), Alcoa Corporation (US), Aluminum Corporation of China Limited (China), RUSAL (Russia), Century Aluminum Company (US), Norsk Hydro ASA (Norway), Constellium (France), Kaiser Aluminum (US), Hammerer Aluminum Industries (Austria), Banco Aluminium Private Limited (India), Maan Aluminium Limited (India), Shenzhen Oriental Turdo Ironwares Co., Ltd. (China), ETEM (Greece), and Alom Group (India) are among the leading players operating in the aluminum extrusion market. To align their manufacturing processes with the constantly evolving regulatory frameworks set by regional governments, companies are actively pursuing various growth-oriented strategies such as contracts, partnerships, mergers & acquisitions, and new technology development. By engaging in these organic and inorganic growth strategies, these companies are working to solidify their market presence in the aluminum extrusion market.

Kaiser Aluminum (US)

Kaiser Aluminum is a North America–based producer with over 78 years of experience in high-quality, value-added aluminum products. Headquartered in Franklin, Tennessee, the company operates 13 specialized manufacturing facilities across North America, producing plate, sheet, coil, and extruded products. Kaiser serves key end markets including aerospace, automotive, packaging, and general engineering, supported by advanced manufacturing capabilities and strong R&D expertise.

Speak to Expert: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=105145109

Alcoa Corporation (US)

Founded in 1886, Alcoa is a global leader in aluminum and a pioneer of modern aluminum production technologies. The company focuses on low-carbon aluminum smelting, efficient alumina refining, and sustainable bauxite mining. Alcoa supplies aluminum to industries such as transportation, packaging, construction, aerospace, and energy, with a strong commitment to achieving net-zero emissions and expanding its portfolio of sustainable aluminum solutions.

Hindalco Industries Ltd. (India)

Established in 1958 and headquartered in Mumbai, Hindalco Industries is Asia’s largest primary aluminum producer and, through its subsidiary Novelis, the world’s largest aluminum rolling and recycling company. Hindalco operates a fully integrated value chain from mining to recycling, serving transportation, packaging, construction, and industrial sectors with a strong focus on lightweight and circular aluminum solutions.

- Искусство

- Разработка

- Ремесло

- Танцы

- Напитки

- Фильмы

- Фитнес

- Еда

- Игры

- Садоводство

- Здоровье

- Дом

- Литература

- Музыка

- История и факты

- Другое

- Вечеринка

- Религия

- Поход по магазинам

- Спорт

- Театр

- Новости