Pest Control Market Size Projected to Reach USD 42.82 Billion by 2032

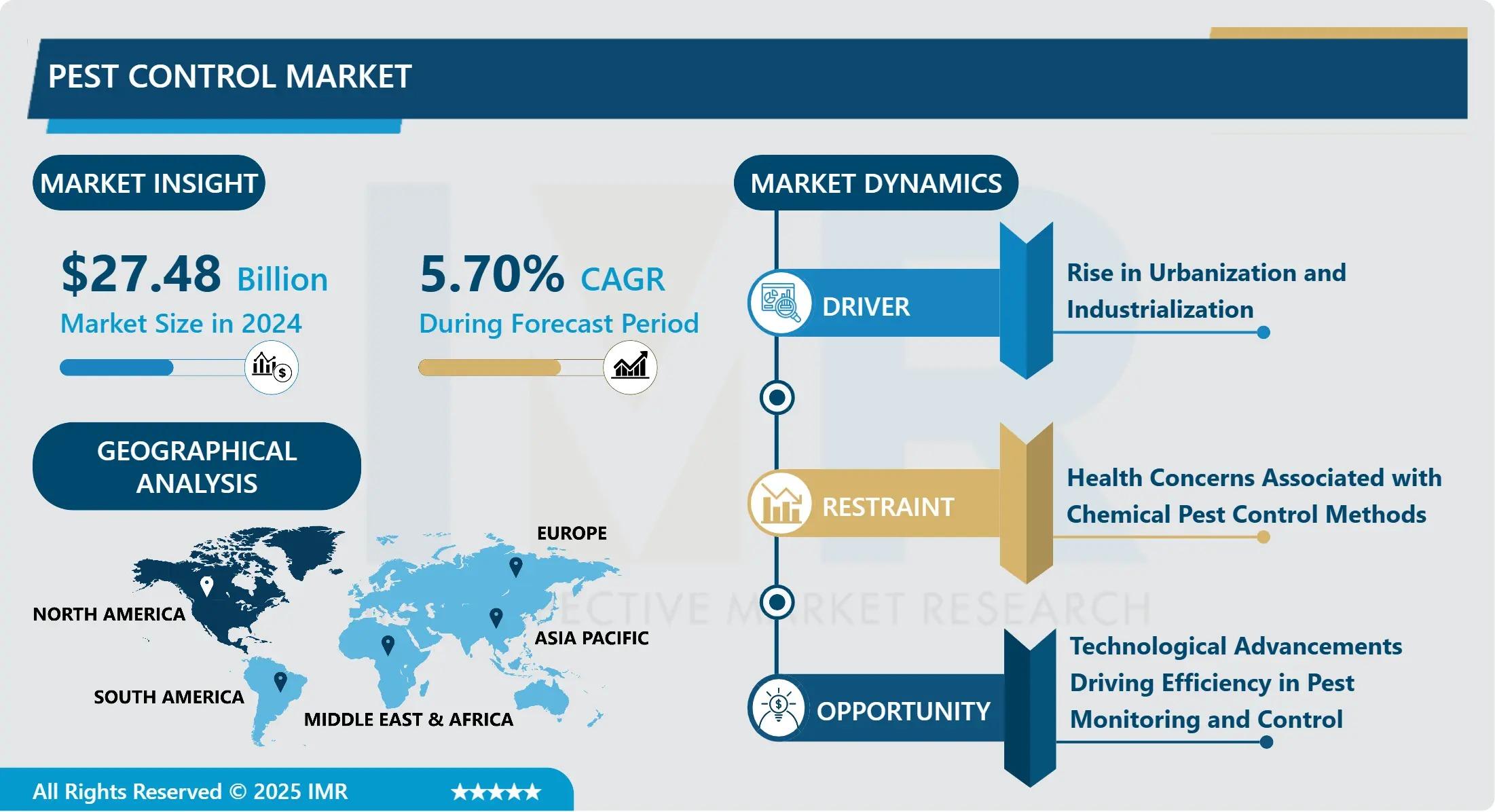

According to a new report published by Introspective Market Research, Pest Control Market by Pest Type, Method, Application, and Service, The Global Pest Control Market Size Was Valued at USD 27.48 Billion in 2024 and is Projected to Reach USD 42.82 Billion by 2032, Growing at a CAGR of 5.70%.

Market Overview

The global pest control market is experiencing steady growth, driven by the universal and persistent need to manage pests that threaten public health, food security, and property. Pest control encompasses a range of services and products designed to prevent, repel, or eradicate insects, rodents, and other unwanted organisms. The industry has evolved significantly from traditional, reactive chemical spraying to integrated pest management (IPM) strategies. Modern methods offer key advantages, including greater effectiveness, targeted application to minimize environmental impact, and the use of non-chemical solutions like biological controls and monitoring traps. This professional approach provides long-term prevention and addresses the root causes of infestations.

Growth Driver

The primary growth driver for the pest control market is the escalating global public health concern surrounding vector-borne diseases and the heightened awareness of pest-related health risks. The spread of diseases like Zika, Dengue, Lyme disease, and illnesses caused by rodent-borne pathogens has placed significant emphasis on proactive pest management as a public health imperative. This is particularly critical in urban and suburban areas with high population density. Governments and international health organizations are increasingly funding and mandating vector control programs. Simultaneously, heightened consumer awareness, fueled by media coverage and educational campaigns, is driving both residential and commercial property owners to invest in regular, professional pest control services as a preventative health measure, rather than a reactive solution.

Market Opportunity

A significant and high-growth market opportunity lies in the development and adoption of eco-friendly, non-toxic pest control solutions and smart, technology-driven services. There is increasing consumer and regulatory pressure to reduce the use of traditional chemical pesticides due to concerns about toxicity, resistance, and environmental impact. This creates demand for green alternatives such as botanical insecticides, biological controls (using natural predators), and insect growth regulators. Additionally, the integration of technology—including IoT-enabled monitoring traps that provide real-time data, drones for precise application in agriculture, and AI for predicting pest outbreaks—allows service providers to offer more efficient, data-driven, and premium-priced solutions. Companies that lead in green innovation and digital transformation will capture a growing segment of environmentally conscious and tech-savvy customers.

The Pest Control Market is segmented on the basis of Pest Type, Method, and Application.

Pest Type

The Pest Type segment is further classified into Insects, Termites, Rodents, and Others. Among these, the Insects sub-segment accounted for the highest market share. This includes a vast array of pests such as cockroaches, ants, bed bugs, mosquitoes, and flies. Insects are the most pervasive pest type globally, invading homes, restaurants, hotels, and healthcare facilities. They pose significant threats as disease vectors, triggers for allergies and asthma, and causes of psychological distress. The continuous challenge of insect infestations across all geographies and climates drives consistent, high-demand for control services, making this the largest and most active segment.

Application

The Application segment is further classified into Residential, Commercial, Industrial, and Agriculture. Among these, the Commercial application segment is a major and growing driver. This encompasses a wide range of businesses including food processing plants, restaurants, hotels, offices, retail stores, and warehouses. These establishments face strict health code regulations, have a low tolerance for pests due to brand reputation risks, and often require customized, ongoing service contracts. The critical need for compliance and protection in the commercial sector makes it a high-value and relatively recession-resistant segment for pest control companies.

Some of The Leading/Active Market Players Are-

· Rollins, Inc. (USA) [Brand: Orkin]

· Rentokil Initial plc (UK)

· Anticimex Group (Sweden)

· Ecolab Inc. (USA)

· Bayer AG (Germany)

· BASF SE (Germany)

· Syngenta AG (Switzerland)

· The ServiceMaster Company, LLC (USA) [Brands: Terminix, AmeriSpec]

· Arrow Exterminators, Inc. (USA)

· Massey Services, Inc. (USA)

· Dodson Pest Control, Inc. (USA)

· Cook’s Pest Control (USA)

· Truly Nolen of America, Inc. (USA)

· “and other active players.”

Key Industry Developments

News 1:

In March 2024, Rentokil Initial completed a significant acquisition of a pest control company in the Nordic region, expanding its European service network and customer base.

This strategic move consolidates the fragmented regional market, allowing the global leader to achieve greater operational efficiency and expand its service offerings in a key geographic area.

News 2:

In February 2024, Bayer Environmental Science launched a new digital pest management platform for professional users, integrating monitoring data, treatment records, and predictive analytics.

This technology empowers pest control technicians and facility managers with actionable insights, enabling more precise, effective, and efficient pest management strategies for commercial clients.

Key Findings of the Study

· Insect control and the Commercial application segment are the dominant market drivers.

· North America currently holds the largest market share, while the Asia-Pacific region is experiencing the fastest growth due to rapid urbanization and increasing health awareness.

· Growth is primarily driven by rising public health concerns and increasingly stringent global hygiene regulations.

· Key trends include a strong shift towards eco-friendly and biological control methods and the integration of digital technology and IoT in service delivery.

- Искусство

- Разработка

- Ремесло

- Танцы

- Напитки

- Фильмы

- Фитнес

- Еда

- Игры

- Садоводство

- Здоровье

- Дом

- Литература

- Музыка

- История и факты

- Другое

- Вечеринка

- Религия

- Поход по магазинам

- Спорт

- Театр

- Новости