Market Outlook 2032: Why Anti-Drone Solutions Are Becoming a Global Necessity

Market Outlook

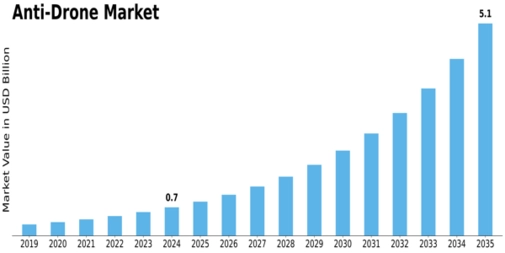

With the Anti-Drone Market valued at approximately USD 0.55 billion in 2023, the forecast to reach about USD 2.62 billion by 2032 signals a strong growth period ahead. A CAGR of around 25 % (2024-2032) reflects the accelerating demand for drone-threat mitigation across multiple sectors.

Industry Overview

Drones have transformed from hobbyist devices to strategic assets. While they enable new capabilities in delivery, inspection and surveillance, they also pose risks: unauthorised incursions, espionage, payload delivery in illicit operations and interference with aviation. As a result, risk mitigation via counter-UAV systems is gaining prominence. The industry now encompasses sensor networks, command/control systems and active neutralisation technologies—delivered via ground infrastructure, mobile units and even airborne platforms. Regulatory frameworks are tightening, and enforcement is becoming more visible, further fueling demand.

Key Players Role

Market leaders are fulfilling critical roles: DroneShield is known for counter-UAS solutions that protect events and infrastructure; Dedrone is noted for sensor-based detection and operator identification. Defence heavyweights like Lockheed Martin and Raytheon are embedding anti-drone capacity into broader defence systems. Their involvement brings scale, certification experience and integration with existing defence and security frameworks. Collectively, these companies are driving system standardisation, lowering costs and expanding availability beyond top-tier defence customers.

Segmentation Growth

The segmentation breakdown highlights key growth areas:

-

Application (Detection): Radar systems dominate due to their ability to detect drones at range and in complex environments. EO/IR, acoustic and other sensors complement radar in specialised cases.

-

Interdiction (Neutralisation): Jammers currently hold the lead by the virtue of being mature and widely deployed. Lasers and other technology-led neutralisation methods are expected to climb as they become more affordable and reliable.

-

Platform: Ground-based solutions dominate given their scale and fixed infrastructure use. Handheld and UAV-based systems are emerging to serve rapid-response, remote or tactical applications.

-

End-User: The defence end-user segment leads, driven by international military spending. However, commercial applications—such as airports, logistics hubs, utilities and major events—are increasingly adopting counter-drone solutions.

Conclusion

The anti-drone market is at a tipping point—moving from niche deployments into broader commercial use and public security. Companies that innovate across detection and neutralisation, partner with security agencies, and adapt to evolving regulations will capture meaningful share. For organisations prioritising air-space safety, this market presents a timely opportunity.

- Искусство

- Разработка

- Ремесло

- Танцы

- Напитки

- Фильмы

- Фитнес

- Еда

- Игры

- Садоводство

- Здоровье

- Дом

- Литература

- Музыка

- История и факты

- Другое

- Вечеринка

- Религия

- Поход по магазинам

- Спорт

- Театр

- Новости